The Teachers State Employee Retirement System (TSERS) administers pension benefits for our Permanent Full-Time Employees working at least 30 hours per week. This pension is automatically put into place for qualifying employees and a mandatory 6% of the employee's paycheck is automatically deducted and contributed into this pension plan.

ORBIT/Retirement Account:

To create an account for a first-time user register here.

Need Help Understanding The Many Aspects Of Your Retirement? Educate Yourself With Online Resources using your ORBIT account.

Retirement Eligibility

Health Benefit Coverage

Types of Service for Purchase

Creditable Service

Using Your Sick Leave

Estimating Retirement Benefits And more!

Teachers and State Employees Retirement System (TSERS) Eligibility

You would be eligible for retirement upon meeting these requirements:

Service Retirement (Unreduced Benefits) ie: payments

You may retire with an unreduced service retirement benefit after you:

Reach age 65 and complete 5 years of membership service

Reach age 60 and complete 25 years of creditable service

Complete 30 years of creditable service at any age

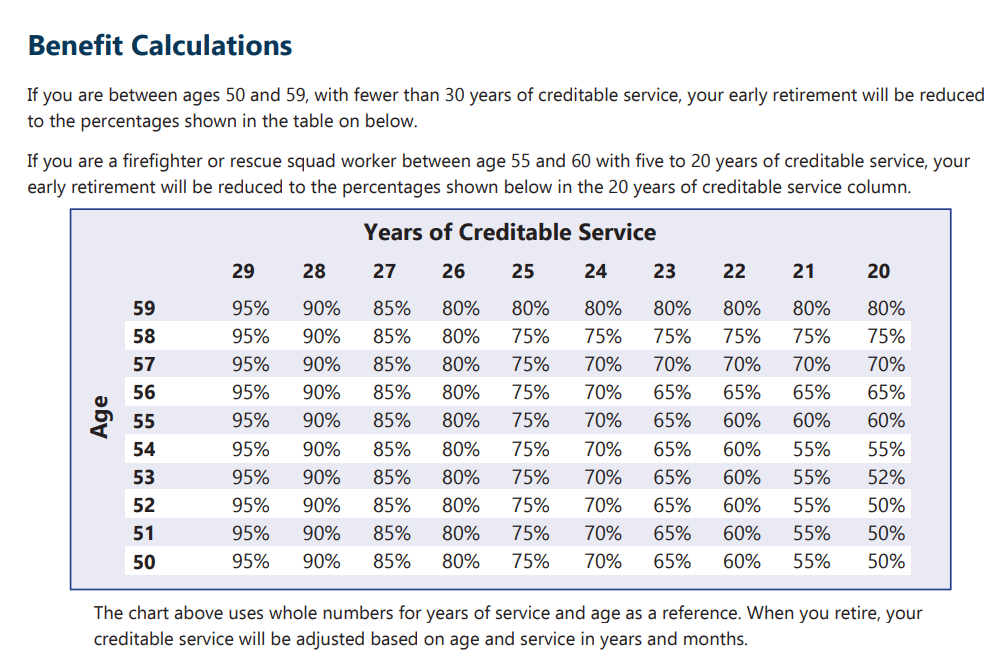

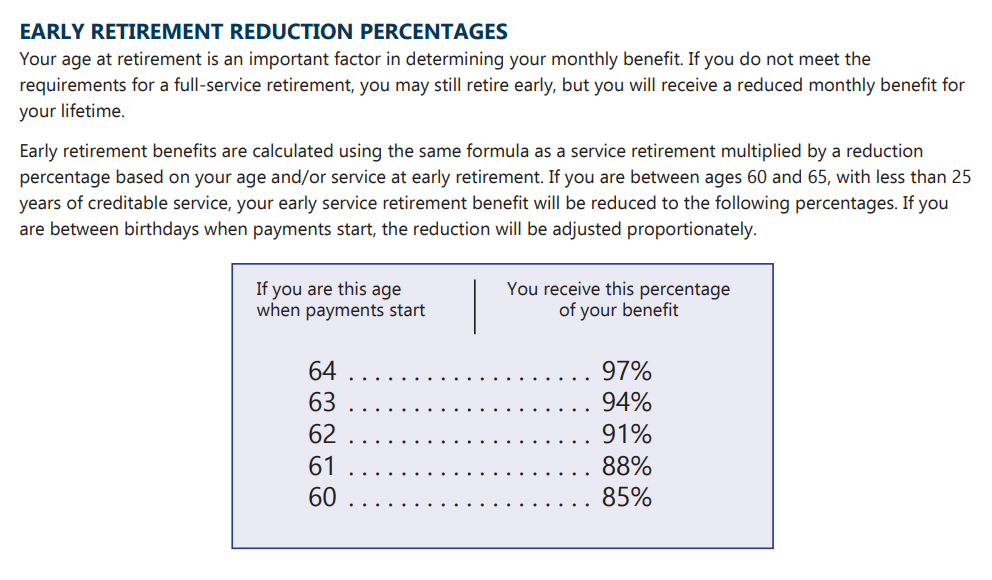

Early Retirement (Reduced Benefits) ie: payments

You may retire early with a reduced retirement benefit after you:

Reach age 50 and complete 20 years of creditable service

Reach age 60 and complete 5 years of membership service

2025 Insurance eligibility page 26 of 2024 TSERS Handbook with QR code to scan

2025 Supplemental Insurance page 27 of 2024 TSERS Handbook with QR code to scan

Click the images to expand them and see all the details.

Additional Insurance Links for 2025

80/20 & 70/30 Plan for 50% Contributory Non-Medicare Subscribers in the Retirement Systems: https://www.shpnc.org/media/3505/open

2025 STATE HEALTH PLAN COMPARISON Active and Non-Medicare Subscribers: https://www.shpnc.org/documents/open-enrollment-documents/2025-active-plan-comparison/open

State Health Plan Retiree Health Benefits Fact Sheet: https://www.shpnc.org/planning-retirement-fact-sheet/open

State Health Plan Planning for Retirement : https://www.shpnc.org/retiree-benefits/planning-retirement

I'm Planning on Retiring - What's Next?

The retirement process can start no more than 120 days prior to your effective retirement date.

The process for a timely retirement (no missed months of income) is 90-120 days.

Employees can schedule inquiry appointments and processing appointments with:

Roberta Powell

Human Resources Coordinator

Phone: 336-438-4000 ext. 20030

Fax: 336-570-6219

Email: roberta_powell@abss.k12.nc.us

Monthly Information Webinar Sessions are emailed out to ALL staff.

Required

NC Teacher and State Employees Retirement System (ORBIT)

NOTE: Members hired on or after January 1, 2021, are not eligible to receive retiree medical benefits.

TSERS (Teacher & State Employees Retirement System) is a Defined Benefit Plan, which means retirement benefits are based on salary, years of service and a retirement factor.

General Information

Must be a permanent full-time employee

Must work 30 hours per week

6% of your paycheck is automatically deducted (this is mandatory)

Sick Leave - add notes here

Supplemental

*Effective April 1, 2022, Empower officially acquired the full-service retirement business of Prudential.

Trusted investment company helping more than 17 million people with saving, investing and advice, while providing them with the tools and resources they need to help reach their financial goals.

Empower/Prudential is the record keeper for the NC 401k and 457 retirement plans.

Offers the only supplemental retirement plans that are endorsed by the NC Department of State Treasurer.

NCDST maintains oversight and fiduciary responsibility, ensuring that the investment options are appropriate, and fees are competitive.

Available assistance with the enrollment process.

Online account access

Investment assistance through a “Goal Maker” investment program.

Low costs, flexibility, and the user-friendly Retirement Income Calculator, which is a financial planning tool.

Convenience of contributing through payroll deduction

Potential tax benefits

Upon separation employees have the option to leave the funds in their account, roll them to another retirement account or withdraw the funds

Stable value, inflation protection, fixed income and equity

Passive and active management

Hardship withdrawals

Loans

In-service distributions (on or after age 59½)

Contact Information:

Tammy Uzzell

Empower Retirement Plan Counselor

Direct Call: 336-207-9452

Schedule a Meeting

Voya is a leading health, wealth and investment company that provides products, solutions and technologies that help Americans become well planned, well invested and well protected.

ABSS 457b

Penalty free withdrawals – Withdrawals are never subject to the 10% federal income tax penalty, regardless of your age at the time of withdrawal.

Permitted Distributions – Severance from employment, death, or attainment of age 70 ½.

Loans are available

Accepts Rollovers

ABSS 403(b)

Permitted Distributions – Attainment of age 59 ½, Disability, Death, Severance from employment

Loans are available

Accepts Rollovers

Both Plans

Automatic payroll deductions which you may change or stop at anytime, and no minimum is required.

Contribution limits – 22,500 for 2023 and the age 50 catch up provision is $7,500 for a total of $30,00

23 investment options including low cost target date funds from Blackrock.

Both plans provide a pretax or post-tax (Roth). This allows you to decide to pay the tax now or later while earning tax deferred growth.

One-on-One Help – Dedicated advisors to help get the most out of your plan and provide advice when needed. Voya advisors can also help with other investment and financial products.

Contact Information:

Aaron Harris: (919) 622-4235

Email: aaron.harris@voyafa.com

Meeting Link

US Omni & TSA Compliance Services (USOTCS) provide compliance services for our 403(b) and 457(b) retirement plans. USOTCS is an independent provider with extensive experience in plan administration, ensuring that our supplemental retirement plans remain compliant and continue to offer competitive investment options.